Nielsen Valuation Texas is your trusted business valuation partner in the Lone Star State for any situation. We pride ourselves on providing accurate and reliable valuations that are unbiased, non-speculative, and fully IRS compliant. Contact us today for your next Texas business appraisal!

Our Locations

Nielsen Valuation Texas has a local presence in the following cities:

We also frequently visit and do on-site interviews statewide, including in El Paso, Corpus Christi, Lubbock, Amarillo, Brownsville / McAllen, Killeen / Temple, Lubbock and Odessa / Midland.

Nielsen Valuation Texas in Brief

Nielsen Valuation Texas provides business valuations that are nuanced, well-weighted, and completely independent assessments of the company in question.

Often, this means determining fair market value while taking into account the company’s current situation and avoiding unnecessary speculation and projections.

In doing so, we carefully examine the business and normalize the income statements and balance sheet for irregularities, one-time payments, and the like, before proceeding with the calculations.

Sometimes discounts for lack of marketability are necessary. We know how to calculate them without relying on theoretical studies, but rather on facts on the ground.

The result is a solid valuation that can be trusted by all parties involved, whether you are using the valuation for a business transaction, a lawsuit, a divorce, a buyout, or any other situation.

IRS Compliant Business Valuations

We operate in full compliance with the principles outlined in the Internal Revenue Service (IRS) Revenue Ruling 59-60.

As such, we place equal, if not greater, emphasis on practical, real-world transactions than the requirements of organizations such as the American Society of Appraisers (ASA), the National Association of Certified Valuators and Analysts (NACVA), or the American Institute of Certified Public Accountants (AICPA).

This means that our valuations prioritize the elements that drive actual transaction outcomes. In doing so, we bridge the gap between standardized methodologies and real-world decision making.

The easiest way to illustrate what this means in practice is to point out what we do not do:

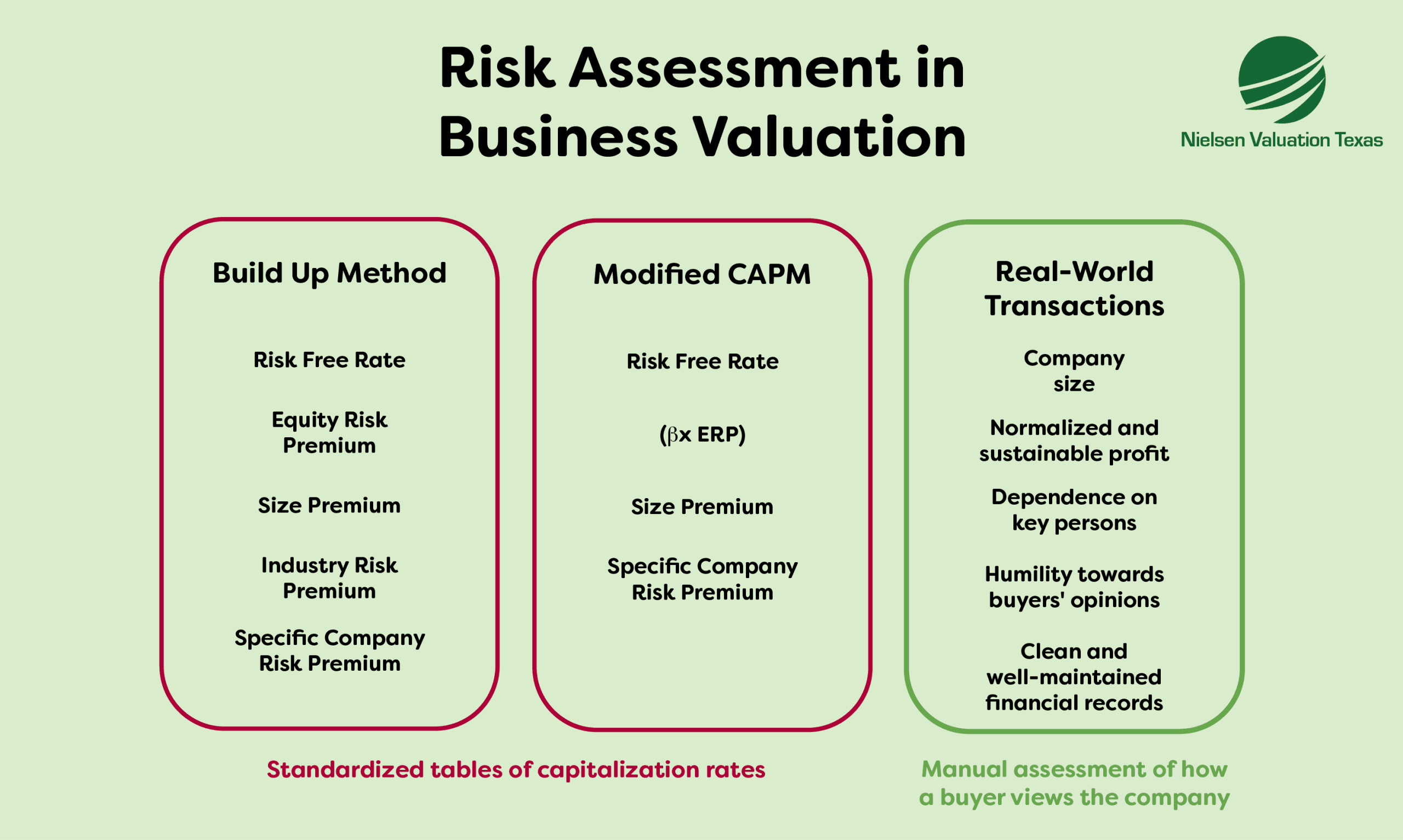

We do Not Rely on Standardized Tables of Capitalization Rates

We never use standardized cap rate tables in our Texas business valuations. Many appraisers use them for convenience. However, we know that they rarely reflect the unique risks, opportunities, and nuances of individual businesses.

Instead, we evaluate, among other things, the nature of the business, the risk involved, and the stability or irregularity of its earnings.

This is consistent with IRS Ruling 59-60, which states:

”No standard tables of capitalization rates applicable to closely held corporations can be formulated.”

We Do Not Use Predetermined Formulas

Closely related is the use of predetermined formulas. Or rather, the lack of them in our business appraisals.

In fact, many do not realize that some of the business valuations available on the market are based solely on formulas and are simply a calculation based on the income statements and balance sheet.

Such valuations give a false picture of the value of the business. It is wasted money.

The IRS is clear on this point:

“Valuations cannot be made on the basis of a prescribed formula.”

“No general formula may be given that is applicable to the many different valuation situations arising in the valuation”

“Such a process excludes active consideration of other pertinent factors, and the end result cannot be supported by a realistic application of the significant facts in the case except by mere chance.”

Rather than following a formula, we assess each business in detail, including its operating and financial history and prospects. If necessary, we conduct interviews and visit the company to gather input for our evaluation.

We Do Not Rely on Theoretical Marketability Discount Rates

A marketability discount rate is a percentage reduction applied to the valuation of a business that is not expected to sell quickly at fair market value.

Nielsen Valuation Texas does this based on observed transaction behavior and market dynamics. Not theoretical marketability discount rates.

The contents of RR 59-60 are available in the appendix of this document.

Our Business Valuation Services in Texas

Your Independent Texas Business Valuation

Whatever the situation, we can help you with your Texas business valuation. Independent and accurate, with finding the correct value as our only goal. We appraise businesses of all sizes and in all industries and sectors, except start-ups.

Selling a Business

If you are preparing to sell your business, we can help you prepare your business for the marketplace. Our independent business valuation will not only show you what you can expect and what a fair asking price would be – it can also help you gain the trust of potential buyers.

Exit Planning

Exit planning is all about setting the stage for a successful future sale. By preparing yourself and your business in advance, you can ensure a smoother transition, future marketability and a higher sale price.

Investments

Looking for a business for sale in Texas? We can help you find the right opportunities and act as an independent advisor to facilitate meetings and negotiations. Finally, we will help you determine if the price you are asking is right.

Mergers & Acquisitions

Make sure you have the right company valuation before you enter into negotiations. Nielsen Texas Valuation provides an independent, trustworthy valuation that strengthens your position and builds confidence among all parties.

Small Business Valuation

We are experts in small business valuations. We are prepared to perform any private company valuation except startup valuation.

Business Appraisals for Financial Planning

With an unbiased corporate valuation in hand, you can make the right decisions for the future. An appraisal from Nielsen Valuation Texas will help you make better financial plans, including decisions about long-term investments and financial strategies.

ESOPs

Nielsen Valuation Texas can help you determine the appropriate share price of your private equity for your Employee Stock Ownership Plans (ESOP).

Partnership Buyouts

Not sure what a fair price would be for your business partner’s shares? We can help you with an independent business valuation that all shareholders can trust. We can also facilitate the share transfer agreement.

Shareholder Agreements & Disputes

We provide expert business valuations to help resolve shareholder disputes – or prevent them altogether by assessing the fair value of the business prior to drafting a shareholder agreement, a task we can also help you with.

Business Valuation in Divorce

With our expertise in private company valuations, we help ease the challenges that come with divorce when you or your former partner owns equity. An appraisal from Nielsen Texas Valuation provides you and your former partner with a trusted, objective valuation.

Litigation

Nielsen Texas Valuation has extensive litigation experience. We provide business valuations that are consistent with IRS rulings and will be accepted in court.

Estate Planning

We help you assess the value of your business to make the right decisions and allocations in your will and estate planning.

Business Valuation for Tax Purposes

Business transactions involve paperwork and calculating tax obligations. We can help you get the numbers right before you file your taxes.

How To Value a Business – Business Valuation Methods

Choosing the right business valuation method – or methods – is key to determining the fair market value of a business, as is knowing how to implement them in practice.

When you engage our services, we select a methodology that is appropriate for the business in question and the context in which the valuation is being conducted.

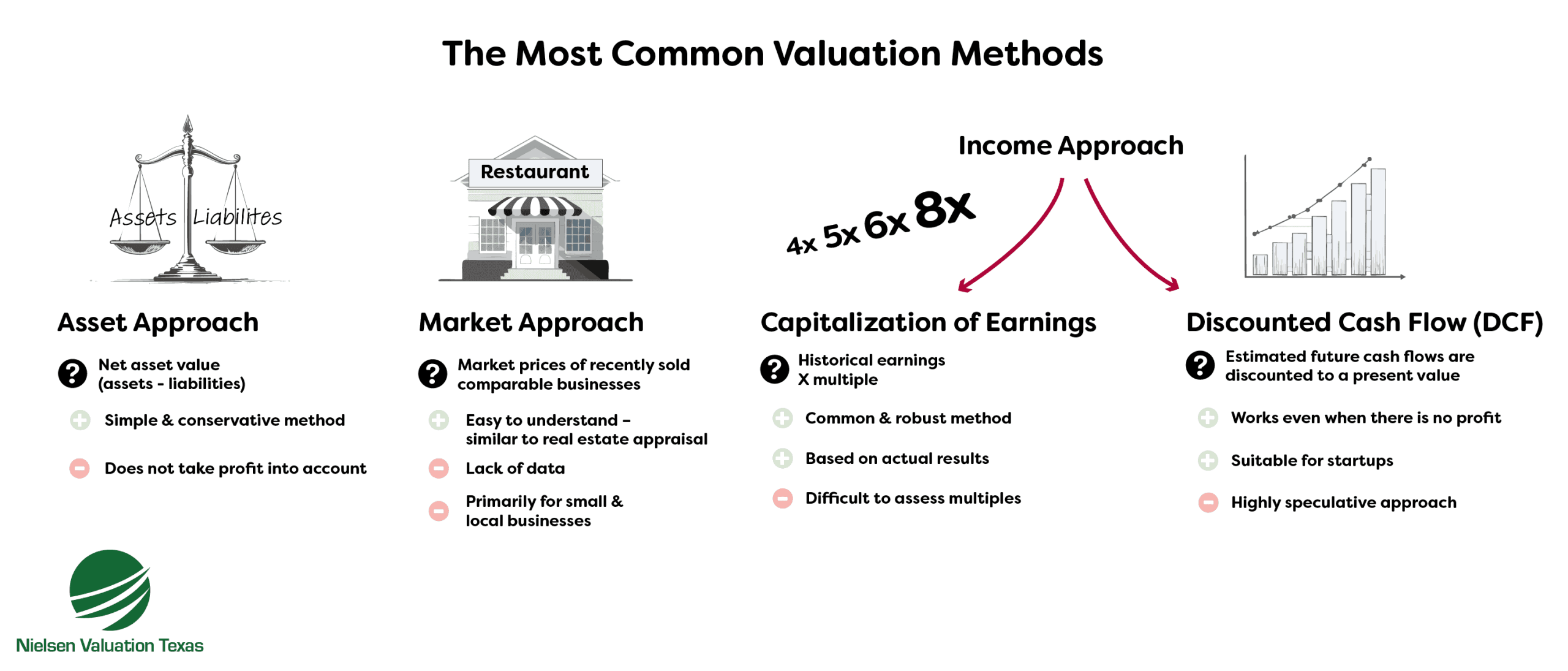

There are many valuation methodologies, but they can be grouped into three main types:

- Asset Approach

- Income Approach

- Market Approach

Let us briefly introduce them:

Asset Approach

The asset approach is about finding the net asset value of the company. It means subtracting total liabilities from total assets. For an asset-based valuation to reveal fair market value, it must take into account the market price of liabilities and assets, not just book value.

While it is well suited to valuing asset-heavy businesses, it does not take into account earnings. Therefore, in most cases, it must be combined with the income approach.

Read more about the asset approach

Market Approach

The market approach is to estimate the value of the business by looking at what similar businesses are selling for.

Its beauty lies in its simplicity and the fact that the valuation is based on real transactions. Therefore, it is often the best valuation method when the conditions are right.

To be accurate, the data set must be cleaned of statistical outliers. It also suffers from the notable weakness that sufficient and timely data is rarely available. In addition, the data must be carefully scrutinized before being used. If there is not enough information about how the data was collected, the dataset becomes unusable.

This method is often combined with the income approach to arrive at an estimate that is closer to fair market value.

Read more about the market approach

Income Approach

The income approach is a valuation method based on the estimated risk of the business in combination with its expected future earnings.

The basic premise is that the value of a business is directly related to its ability to generate income. There are several methods used within the income approach, the two main ones being capitalization of earnings and the more speculative discounted cash flow (DCF) method.

Read more about the income approach

Combination And Weighting of Valuation Methods

It is possible, and even common, to do combinations or weighting between valuation methods.

Let us explain the difference:

- Weighting is assigning a percentages of the valuation among different valuation approaches. For example, mathematically do 30% of the valuation according to the asset approach and 70% according to the income approach.

- Combining approaches, is commonly done by adding the net asset value, to an income approach valuation.

Let us look at an example of weighting between valuation methods:

- A company has assets of $1,000,000 and liabilities of $500,000. The net worth according to the net asset method is therefore $500,000.

- Annual earnings are $3,000,000 and the business valuator has decided that an earnings multiple of 3 is appropriate. This results in a valuation of $9,000,000 based on the income approach.

- The appraiser decides to weight the asset and income approaches 50/50. Therefore, the final valuation is $250,000 + $4,500,000 = $4,750,000.

Can you see the issue with this standardized approach? Weighting between valuation methods is not necessarily wrong, but it should not be done in a standardized way, without exercising your judgement. Here is what the IRS has to say about it:

“Because valuations cannot be made on the basis of a prescribed formula, there is no means whereby the various applicable factors in a particular case can be assigned mathematical weights in deriving the fair market value. For this reason, no useful purpose is served by taking an average of several factors.“

Normalization Is Critical

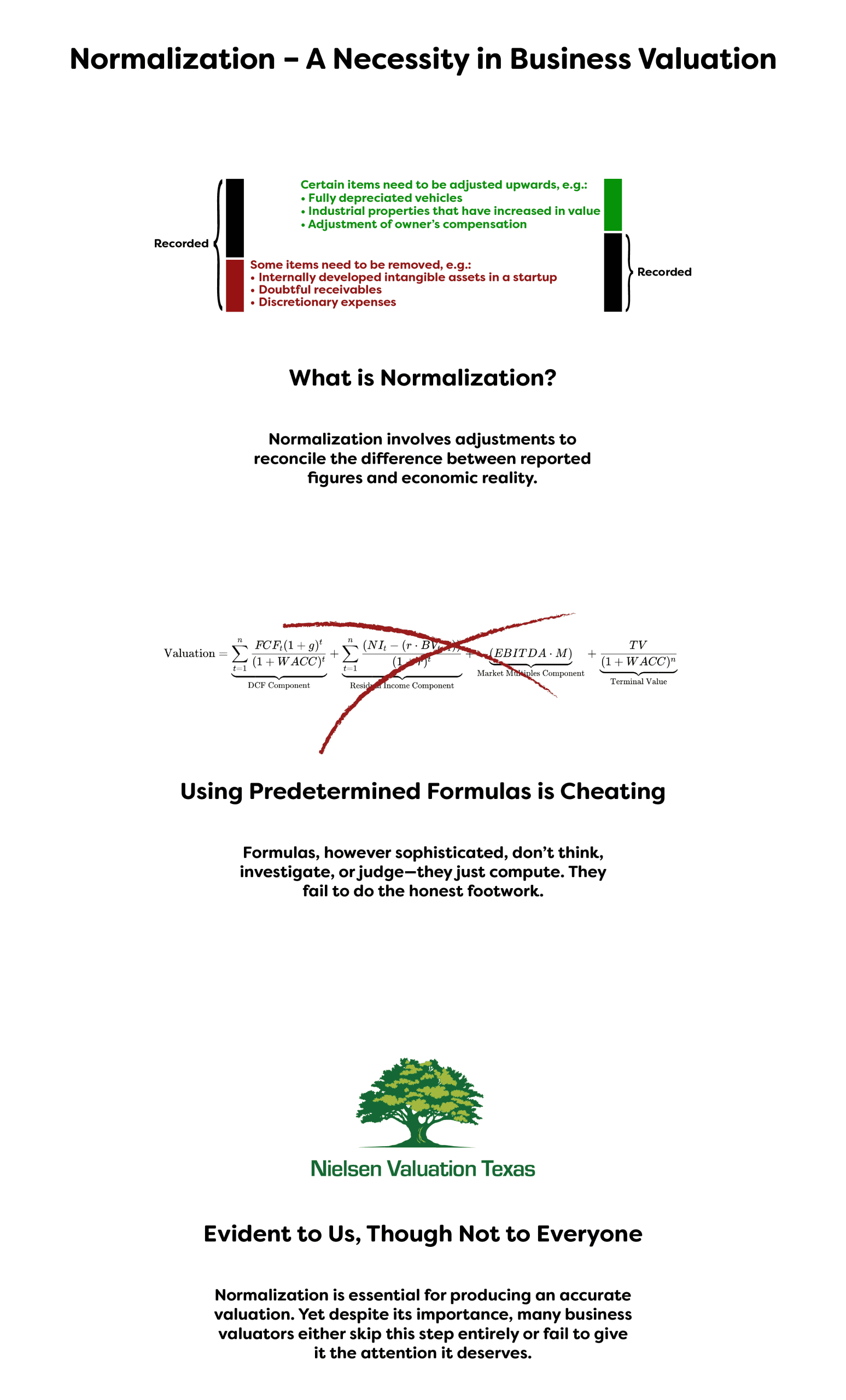

Before running any valuation calculation, you must normalize the income statement and balance sheet.

Applying a formula is easy; knowing which figures actually belong in the formula is the hard part.

Many valuers skip this step, using standard formulas without adjusting for inflated or deflated line items in the both the P&L and balance sheet. In doing so, they miss one of the most critical parts of valuing a business.

Common inflations include:

- Intra-group receivables with no real coverage

- Internally developed intangible assets

- Unpaid fair-market salaries (owners working without salary) inflated

Common deflations include:

- Real estate booked at its original purchasing price (which may be 15 years ago)

- Non-operating expenses

- Fully depreciated vehicles and machinery

If applying the income approach, the income statement must be normalized. If using the asset approach, the balance sheet must be adjusted accordingly. The most reliable valuations incorporate elements of both—ensuring all relevant financials are normalized. Quality in valuation comes from rigor and relevance, not by replacing the foot work with padding in the valuation report.

How Much Is My Business Worth?

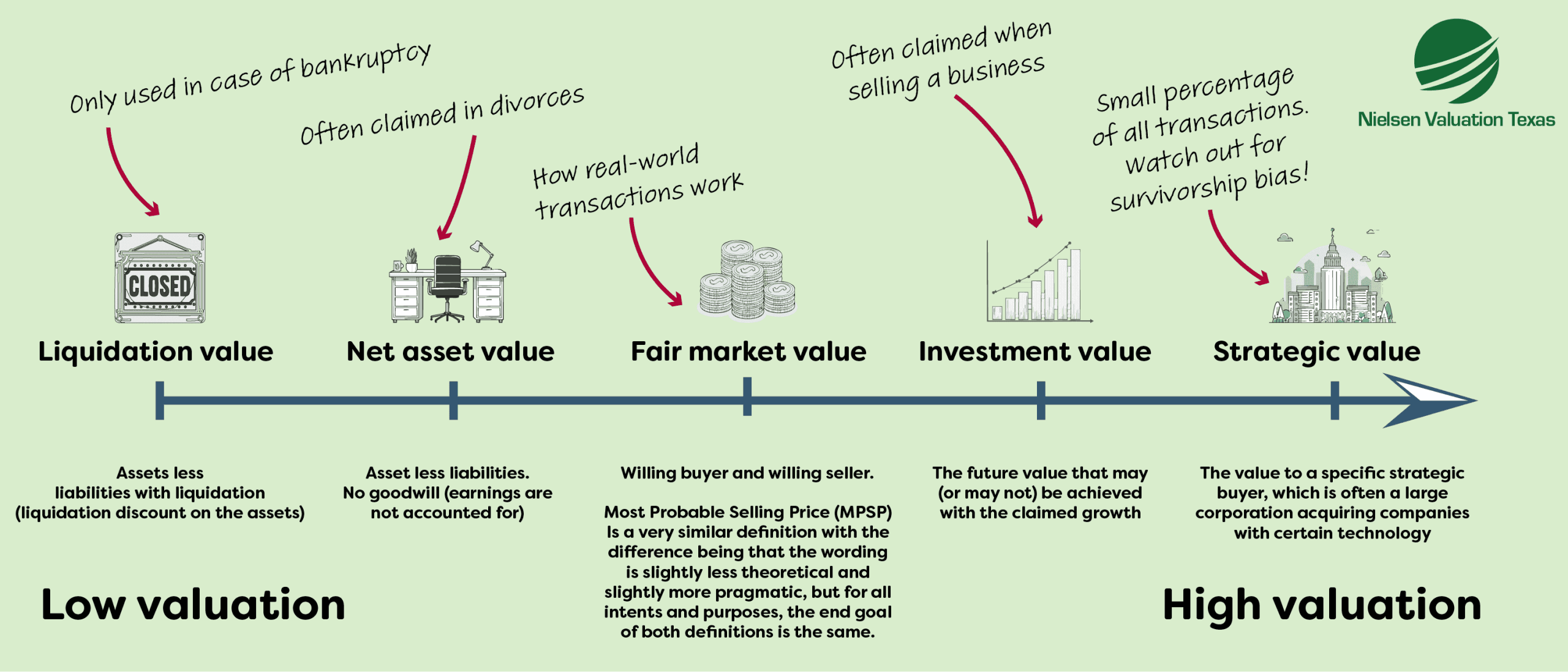

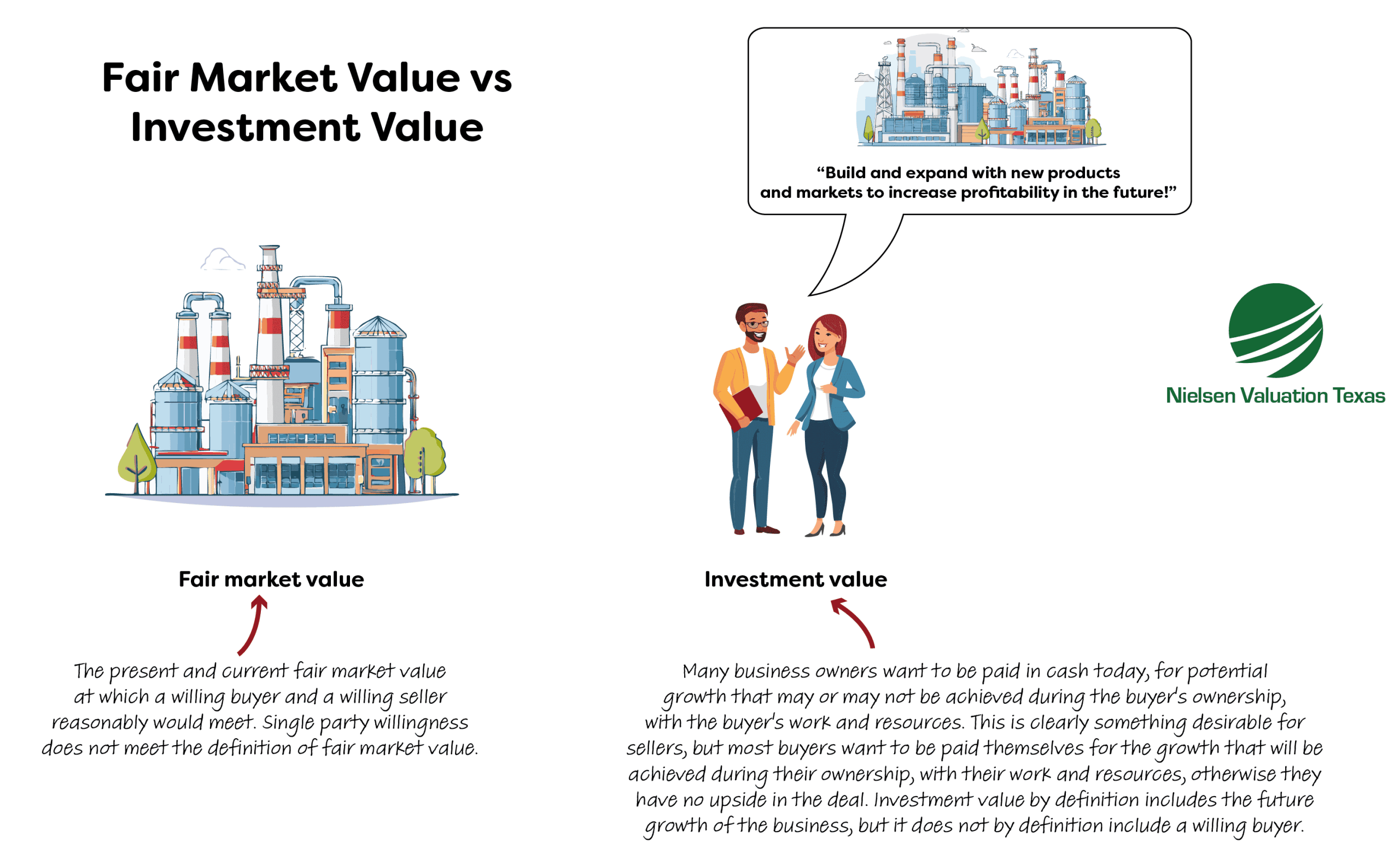

How do you value a business for sale? Your goal should be to determine the fair market value of the business. This is the price at which you will be able to find a willing buyer. This is how the IRS defines it:

“Define fair market value, in effect, as the price at which the property would change hands between a willing buyer and a willing seller when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, both parties having reasonable knowledge of relevant facts. Court decisions frequently state in addition that the hypothetical buyer and seller are assumed to be able, as well as willing, to trade and to be well informed”

Simply applying a standardized approach with arbitrary five- or ten-year averages will not reveal fair market value. Instead, historical earnings records are helpful in estimating how much the business is actually worth. The IRS says:

“Prior earnings records usually are the most reliable guide as to the future expectancy, but resort to arbitrary five-or-ten-year averages without regard to current trends or future prospects will not produce a realistic valuation.”

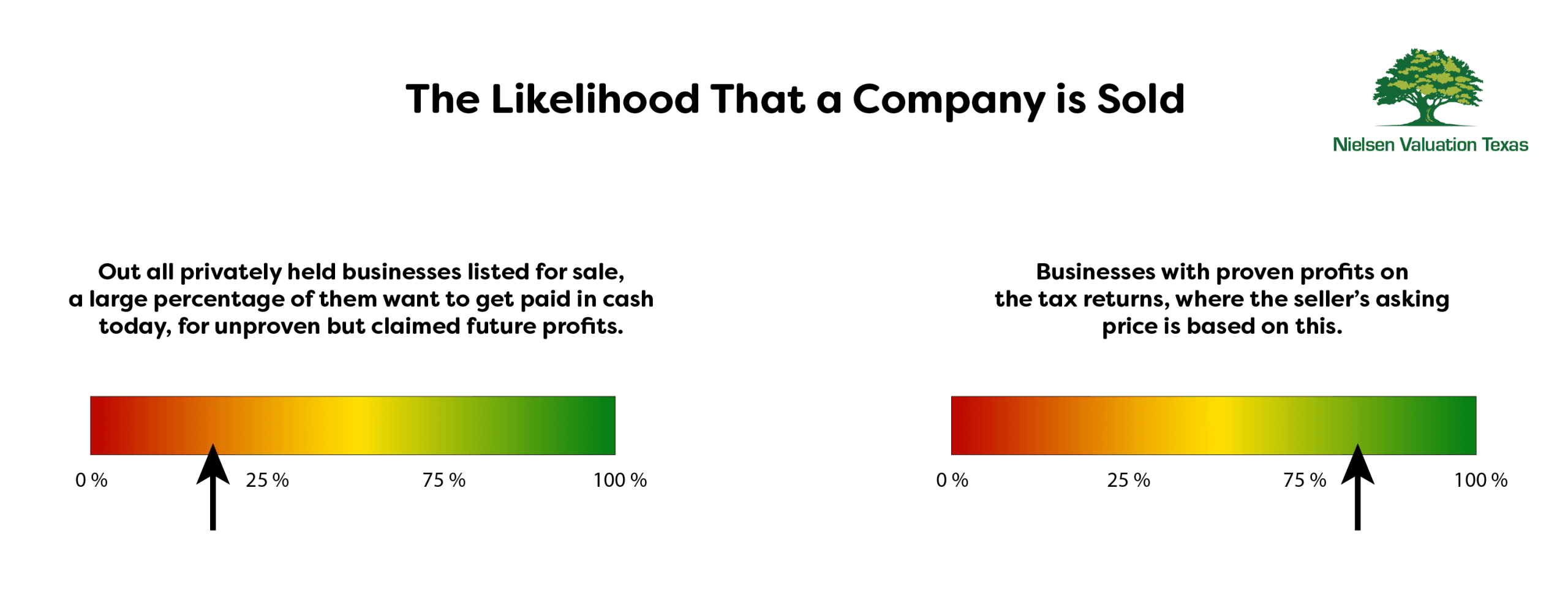

We encounter many misconceptions about how much a business can sell for. Two stand out:

Common Mistake #1: Survivorship Bias

During World War II, studies were made of planes returning to base. Notes were made of where they were hit.

This information was used to determine where additional armor was needed. Since no planes were hit in the cockpit, engines, and parts of the wings, it was incorrectly concluded that they did not need reinforcements. The reality was that the planes that were hit in these areas never returned.

This coined the term “survivorship bias,” and it is very common in the business world.

Founders often look at companies that have succeeded when assessing their own company’s prospects. They point to companies like Spotify, PayPal, Microsoft, Meta, or Alphabet.

The problem is these are success stories. They are the survivors. For every successful company, there are at least nine that fail to even survive, let alone thrive.

Only about 10% of startups survive in the long run. 90% fail, 10% of them within a year.

As a result, what a buyer is willing to pay is often much less than what the seller expects.

Common Mistake #2: Confusing Fair Market Value with Investment Value

Many business owners want to be paid in cash today, for potential growth that may or may not be achieved during the buyer’s ownership, with the buyer’s work and resources.

This is clearly something desirable for sellers, but most buyers want to be paid themselves for the growth that will be achieved during their ownership, with their work and resources, otherwise they have no upside in the deal.

Investment value by definition includes the future growth of the business, but it does not by definition include a willing buyer. A buyer wants to pay the fair market value.

Selling Potential vs. Selling Reality

Some business sellers, appraisers, and intermediaries argue that a buyer should pay a premium based on the business’s projected future growth. These arguments are typically grounded in hypothetical improvements that have not yet occurred and may never materialize. They reflect possibilities — not present realities.

However, such reasoning directly conflicts with the standards set forth in Revenue Ruling 59-60, which instructs that a business must be valued based on all facts that are known or reasonably knowable as of the valuation date.

To illustrate: a boat dealer cannot credibly market a small inflatable raft as a luxury yacht simply because the buyer could someday equip it with an engine, radar, and luxury finish. The price must reflect what is actually being transferred — not a hypothetical version that does not yet exist.

In the same way, a buyer should not be asked to pay today for a business they are told it could become in the future. Valuation must rest on what has been actually achieved — current earnings, net assets etc— not on abstract potential. This valuation remains firmly rooted in that principle.

Valuation Conclusions Based on Facts at the Time of Appraisal

Revenue Ruling 59-60 makes clear that valuation conclusions must be based on the facts as they exist at the time of appraisal.

This is consistent with how any honest market participant would behave. A seaworthy yacht in clean, functional condition is not priced the same as one already corroded and in disrepair. The fact that vessels are projected to eventually wear down does not justify devaluing one that is demonstrably sound today. Likewise, a business must be valued based on its current demonstrated condition.

This analysis respects both the substance and intent of Revenue Ruling 59-60 by focusing on what is actually known and measurable, rather than what may or may not occur in the future. The result is a valuation based on sound judgment and objective reality — not speculative projections.

7 Common Business Valuation Mistakes

- Choosing the wrong method: If you value a business with irregular or low profits and cash flows and rely only on the income approach, the valuation may be wrong. Similarly, if you value a fast-growing service business based only on its assets, the valuation will be misleading.

- Avoiding normalization: If you use the asset method and use the face value of the assets as what is on the balance sheet instead of using market value, the valuation will be wrong. If you use the income approach, the valuation will be misleading if you do not adjust income and expenses for irregularities.

- Not weighting earnings: In theory and in theoretical valuations, all financial key numbers, especially the earnings, follow industry averages and have no variation from year to year. In the real world, small businesses generally have heavy fluctuations (such as twice as high, or less than half) between fiscal years, and in real-world transactions, each individual fiscal year is discussed, why it is or is not representative for the business going forward. This is never brought up in theoretical valuations, but in real-world transactions, this is almost always what impacts the valuation the most.

- Lack of understanding of the business: There is always a reality behind the numbers, a business with activities, plans, ideas, culture and people. Figures can sometimes be manipulated, but by looking at the reality, the picture becomes clearer.

- Using a business valuation calculator: Using any pre-determined formulas, calculations or calculators will always give the wrong value because the input values must first be normalized. Without the groundwork, the calculation will be wrong.

- Thinking the value is set in stone: It is common to hear things like, “My business appraiser said the business is worth…”. The truth is that two valuators can come up with two very different valuations. What the business is really worth is what someone is willing to pay for it. So there is no point in being overly optimistic. Instead, try to come up with a reasonable valuation.

- Relying solely on a business broker for your valuation: While they may be able to help you sell your business if it is small and local, most businesses for sale never find a buyer. Why? Business brokers tend to overvalue the business to get a higher commission, which makes it harder to sell.

Why Choose Nielsen Valuation Texas?

Nielsen Valuation Texas is your trusted partner for business evaluations in the Lone Star State – and beyond.

We pride ourselves on providing completely independent business valuation services. We do not charge commissions on sales and have no other interest than to provide you with a well-balanced appraisal that reflects the fair value of the business.

Our methodology is robust and fully compliant with IRS rulings. We avoid unnecessary speculation because we believe a valuation should be as reliable as possible and reflect real transactions.

We always normalize the income statements and balance sheet to correct for irregularities and to reflect market valuations.

If discounts for lack of marketability are necessary, we calculate them without relying on theoretical studies, but rather on facts on the ground.

Each evaluation is tailored to the business under examination. We also take into account the reason for the valuation. There is no one-size-fits-all approach to business valuations.

If necessary and requested, we will visit the business, inspect its facilities and conduct interviews.

The report you receive is to the point and avoids fluff and jargon. Our standards are high. Our valuations have been used successfully in court on many occasions.

This makes us your top choice for business valuation in Texas. Whether you need an appraisal for the sale or acquisition of a business, a lawsuit, a divorce, or any other purpose.

Make a Business Valuation in Texas Now!

We are here to help you with your Texas business valuation. Contact us now for a free consultation and quote!