We can help you with an unbiased business valuation in Austin for any situation

Nielsen Valuation Texas provides independent business valuation services in Austin, TX. Our business appraisals are always customized, non-speculative, unbiased, and in full compliance with IRS regulations. Contact us now for a quote!

Our Services in Austin

We offer business valuations for any situation, except startup valuations:

- Selling a business

- Buying a business

- Mergers and acquisitions

- Attracting investors

- Partner buyouts, buy-sell agreements and shareholder disputes

- Divorce settlements

- Estate planning and inheritance

- Tax planning and compliance

- Business restructuring or business dissolution

- Securing business loans or financing

- Insurance purposes

- Litigation support

- ESOP

- Financial reporting & strategic planning

- And more!

Why Choose Us for Your Valuation?

Nielsen Valuation Texas is your local business valuation expert in the Lone Star State. We have offices in Austin and other cities throughout Texas. Our local presence makes it easy for us to arrange a meeting if you wish, or to visit the business being valued.

Our valuations are often described as unbiased and well weighted.

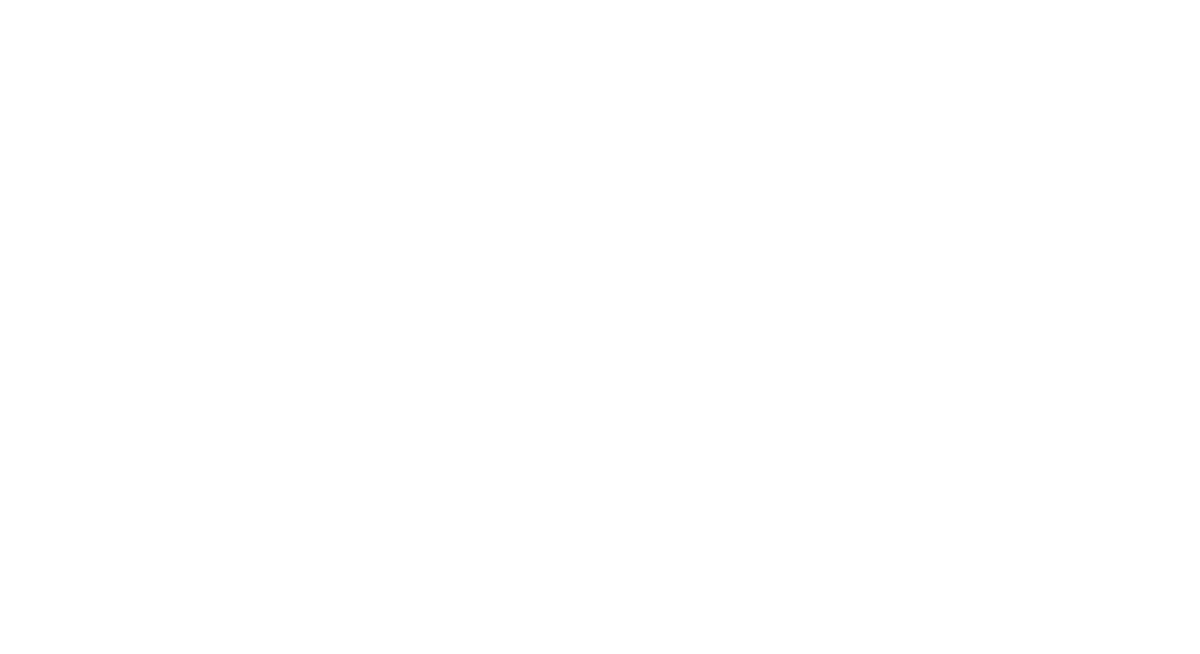

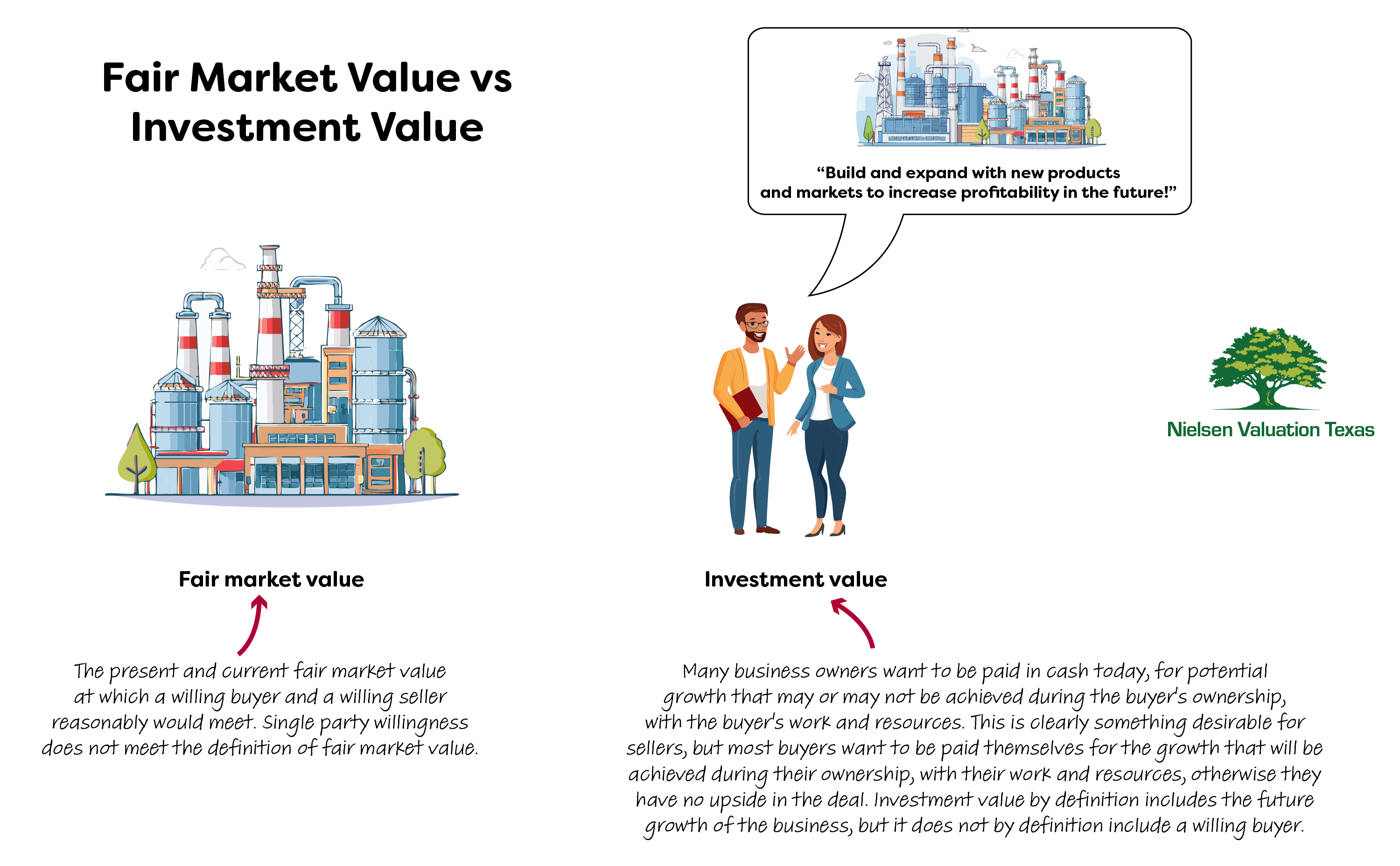

In most cases, we focus on determining the fair market value of the business, but the reason for the valuation needs to be taken into account. We always avoid speculation. This gives our valuations the credibility to be used in challenging situations such as negotiations and litigation.

Non-Speculative Valuations & Full IRS Compliance

It is not uncommon for business valuation firms to rely on loose assumptions or even speculation, as well as predetermined formulas. Such appraisals do more harm than good.

Whether you are selling your business, buying a business, need a divorce valuation – or for any other reason – you need to be able to rely on the appraisal.

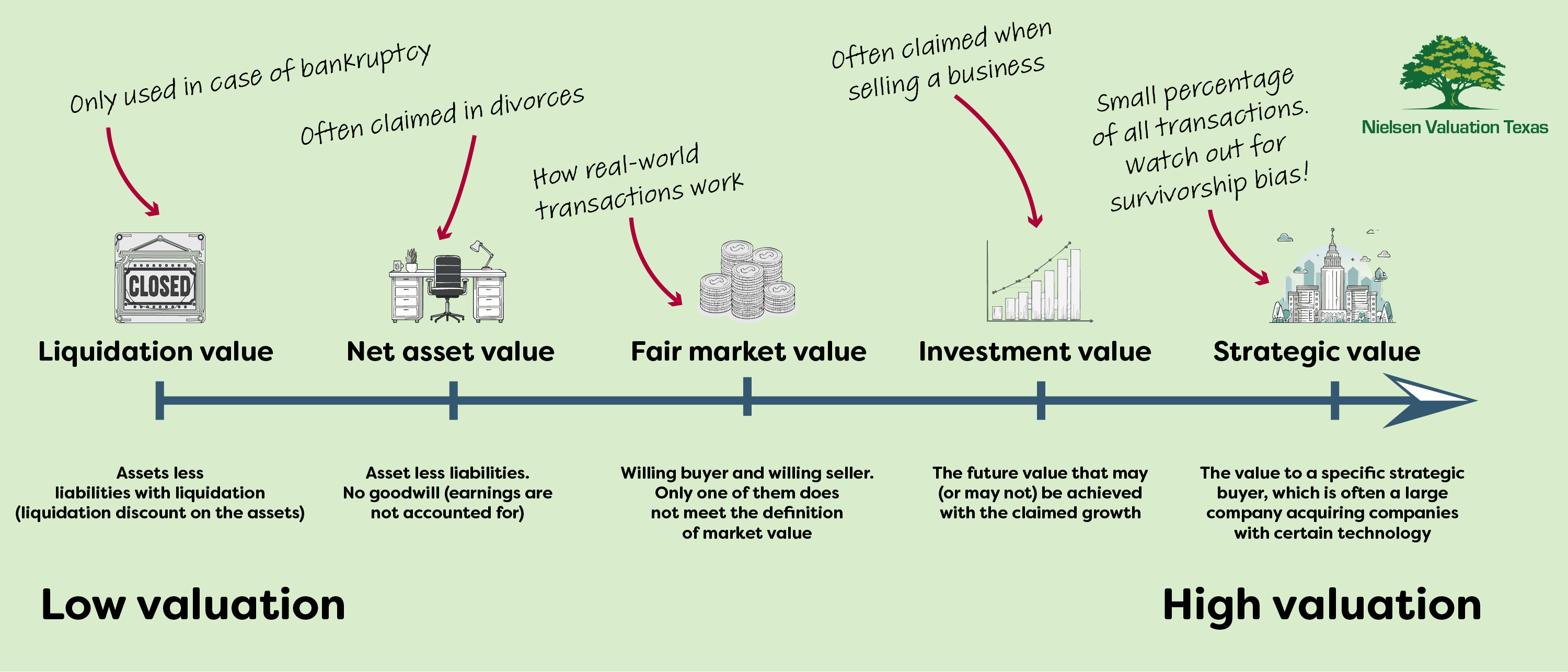

The Internal Revenue Service (IRS) Revenue Ruling 59-60 has made it clear that business valuations should not be based on predetermined formulas, standardized capitalization rates, or theoretical marketability discount rates.

When we prepare your Austin business valuation, we make sure it fully complies with this IRS ruling. This gives it weight whether you use it in negotiations with a buyer, seller, or business partner – or need it for litigation.

Regardless of the situation, our business valuation services always take into account the reality of the business. The facts on the ground and the actual situation in the company.

Seeing Beyond the Numbers

A common mistake in company valuation is to use the face value of what is on the balance sheet or income statements. When you do a simple online valuation, this is exactly what happens. It is an automatic calculation based on the available data. As a result, the valuation becomes misleading or completely wrong.

That is why one of our most important tasks when evaluating a company in Austin is to look beyond the numbers – to normalize them, as we say.

This means, among other things, reviewing the balance sheet and adjusting it to reflect the fair value of assets. We also adjust the income statements for irregular or unrepresentative income or expenses.

Our Choice of Business Valuation Methods

While we do not rely on predetermined formulas, we do use one or more valuation methodologies. Our choice of method depends on factors such as the type of business, its earnings patterns, and the purpose of the valuation.

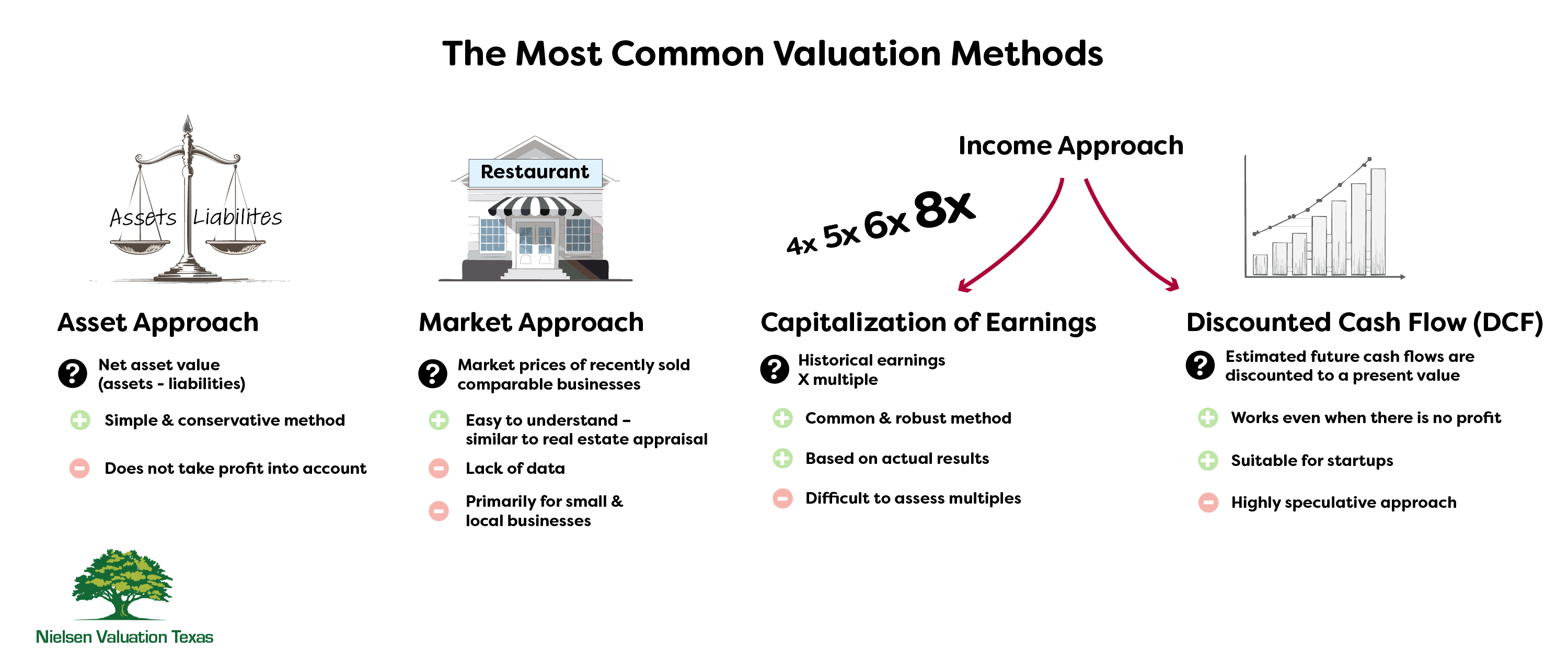

We may use one or more of three approaches:

- Market approach – looks at what similar businesses in Austin sell for

- Income approach – based on income or cash flow

- Asset approach – net asset value at market price

Regardless of the method(s) used, we take care to avoid unnecessary speculation, which ensures a robust and verifiable valuation.

Our Valuation Services in Austin Are Always Customized

We understand that every client and every case is unique. That is why when you contact Nielsen Valuation Texas, you will always receive a personalized response, usually from Mr. Nielsen personally. We will provide you with a customized quote to ensure that you do not overpay for services you do not need.

How Much Is My Austin Business Worth?

Are you planning to sell a business in Austin? Remember that its actual value is what someone is willing to pay for it. Not what some theoretical formula says it is worth.

We often see sellers overly expect a high price based on the potential of the business. Buyers, on the other hand, do not want to pay for any potential since they want to be paid in the future when that potential might be realized. To arrive at a number that is close to what a buyer is willing to pay, you need to do a balanced valuation.

We also see that sellers, especially in startups, suffer from survivorship bias. They usually point to successful startups like Alphabet, Meta, Spotify or PayPal and draw a parallel to their own business. In reality, however, investors and buyers know that just about 1 in 10 startups survive, a fact they must take into account when bidding.

Need a Business Valuation in Austin?

Do you have any questions about our business valuation services in Austin? Would you like to receive a quote or schedule a free consultation?