We provide business valuations in San Antonio for all types of businesses and in all situations

Nielsen Valuation Texas is your trusted choice when you need an unbiased business valuation in San Antonio TX. We pride ourselves on always providing appraisals that are based on the reality of the business – not speculation or predetermined formulas. We operate in compliance with IRS regulations.

Our Services in San Antonio

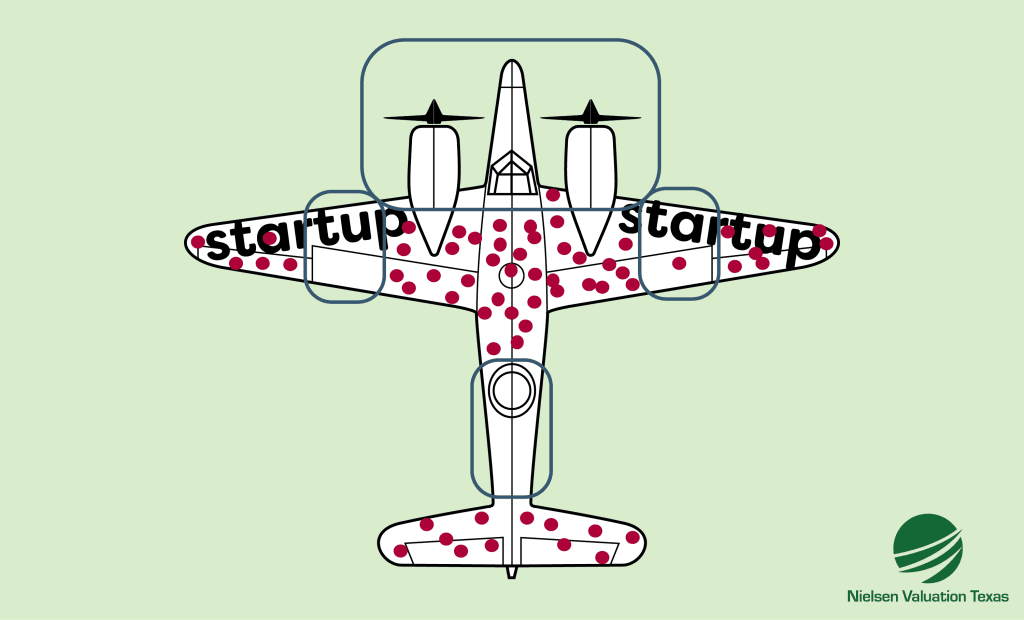

We offer business valuation services in San Antonio for all situations (except startup valuation):

- Buying or selling a business

- Business investments

- Mergers & acquisitions

- Divorce Valuation

- Buy-sell agreements, partner buyouts, & shareholder disputes

- Tax planning & compliance

- Estate planning & succession

- Business financing

- Business restructuring or dissolution

- Insurance

- ESOP

- Litigation support

- Strategic planning & financial reporting

- And more!

Why Use Us for Your San Antonio Business Valuation?

Nielsen Valuation Texas looks forward to meeting you in person in San Antonio. We have a local presence here and throughout the rest of the Lone Star State.

We believe that business valuations must take into account the specific situation of each company in order to estimate its value. Simply looking at the numbers on the balance sheet and income statements is not enough. Our experience and local knowledge is an asset in this task.

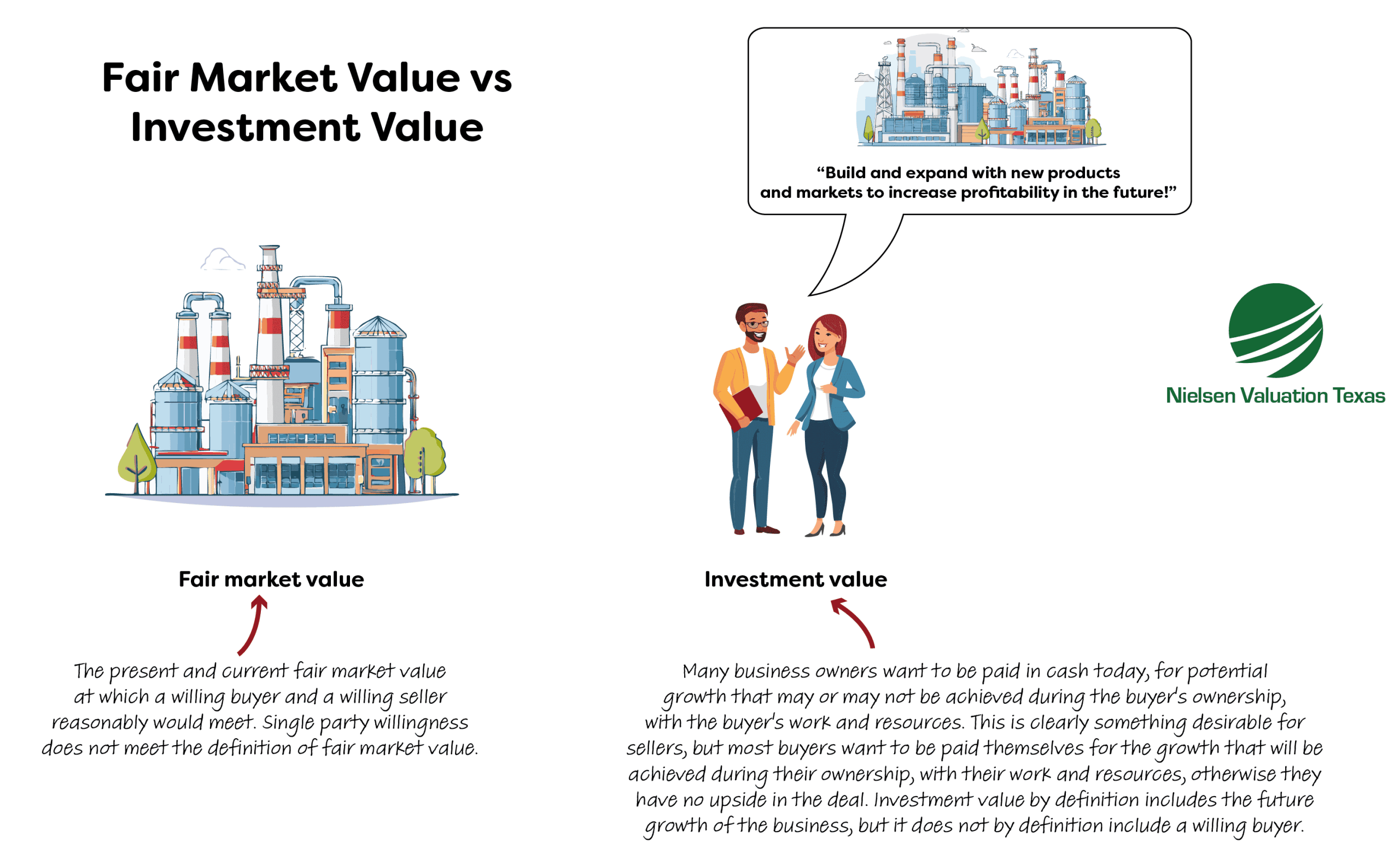

When you engage us, we look beyond the numbers and use robust methodologies to provide a well-weighted and unbiased valuation that is fully compliant with IRS regulations. We aim to determine the fair market value of the business rather than doing speculative and unrealistic projections. We also adjust the valuation to reflect the situation. As a result of our approach, our valuations are credible to all parties and useful in litigation.

We Take No Shortcuts

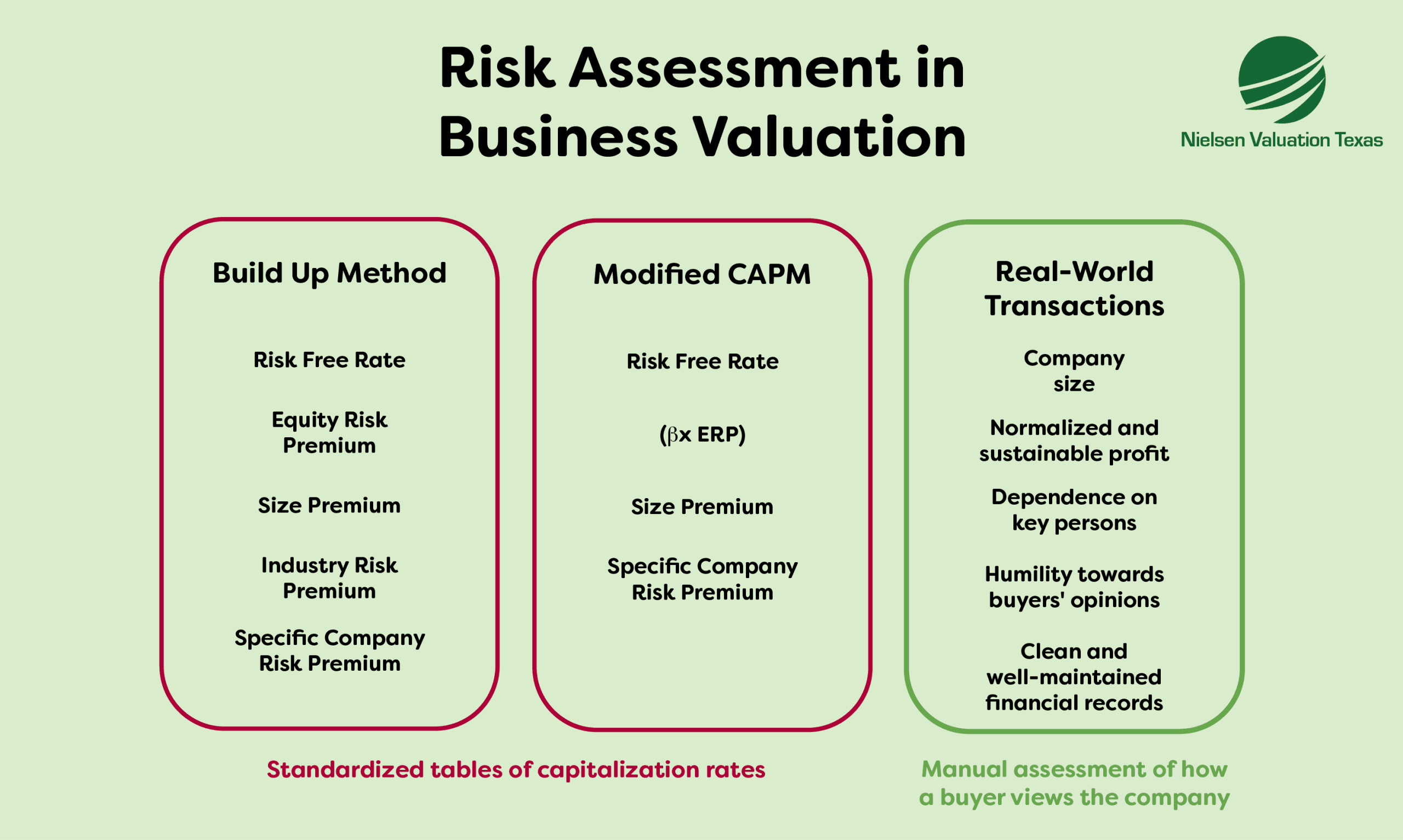

There is a misconception that the value of a business can be determined by applying a formula or simply looking at a table of capitalization rates. Yet some appraisers do. We don’t.

The Internal Revenue Service (IRS) has clearly stated in Revenue Ruling 59-60 that a business valuation cannot use pre-determined formulas. It cannot rely on standardized capitalization rate tables, nor can it use marketability discount rates taken from a theoretical context.

At Nielsen Valuation Texas, we always ensure that our valuations fully comply with these and other IRS guidelines. In our opinion, this is not an option. It is a must.

Instead, we roll up our sleeves and find out what the business is really worth. We take no shortcuts. What this means for you as a client is that the valuation is truly reliable, based on the situation on the ground and the fair market value of the business – its reasonable price in the marketplace.

Finding the Value Beyond the Books

Simply relying on the numbers in the balance sheet and income statements is a common mistake. Unfortunately, even some business valuators take their job too lightly and take what is on the books for granted.

To determine the true value of a business, it is necessary to dig deeper.

- The balance sheet does not show the market value of the assets. So, we find out what the assets are worth before we do any calculations.

- Income statements are easy to manipulate and may contain unrepresentative or irregular income or expenses. We correct this.

Only after the numbers are normalized do we do the calculations. Finally, if marketability discount rates are applicable, we find out what the appropriate discount rate is based on the situation rather than relying on predetermined rates.

We Always Use Robust Methodologies

Ten business appraisers may offer ten different answers when asked about their methods. There is a wide variety of theories, many of which are more theoretical than practically applicable and more speculative than based on true facts.

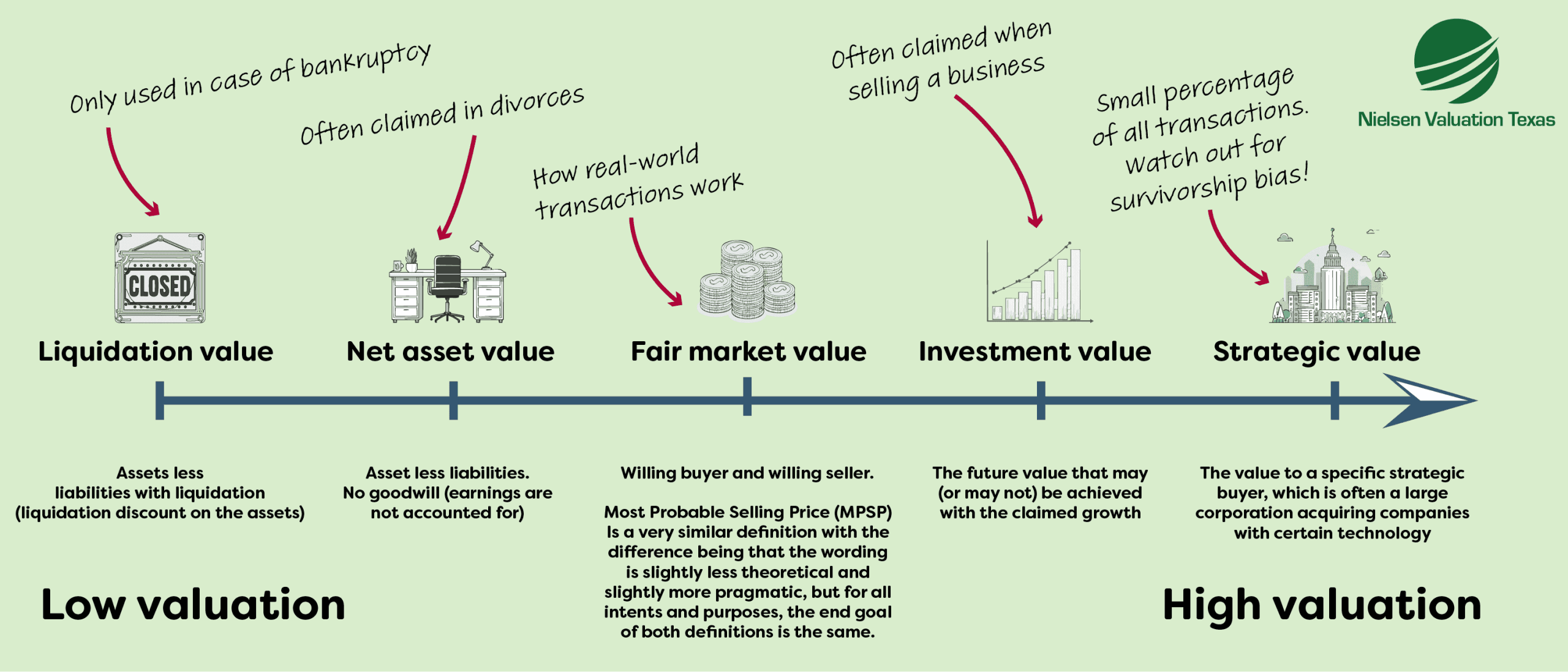

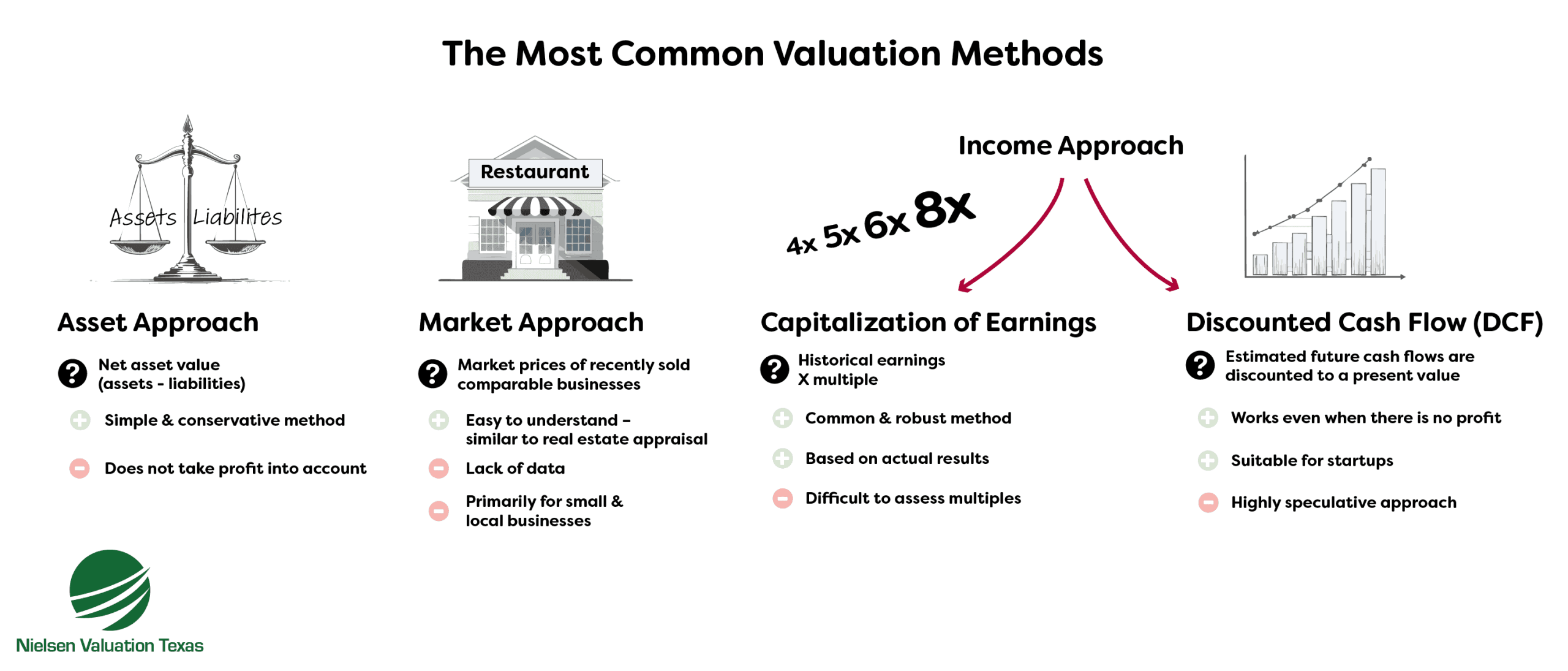

Beyond all theories, there are three fundamental valuation principles:

- Income approach – valuations based on income or cash flow

- Market approach – compares with selling prices of similar businesses

- Asset approach – builds upon the net asset value at market price

We use one or more of these methods when we value a business in San Antonio. The choice and application of these methods depends on the situation, but we always strive to find a correct value of the business, with full regard to the situation.

Our Business Valuations in San Antonio Are Always Customized

When you use our business valuation services in San Antonio, we ensure that you receive a personalized approach. This process begins with our initial contact, during which we offer a complimentary 30-minute consultation to learn more about the business in question and the purpose of the valuation. Following this consultation, we present a customized offer. Our philosophy is that you should never pay for services you do not need.

How Much Is My San Antonio Business Worth?

Want to sell your San Antonio business? Then you need to consider that its value in the marketplace is what a potential buyer is willing to pay. This can be very different from a theoretical calculation.

A common mistake we see is that sellers expect to be paid for the potential of their business. Buyers, however, do not want to be paid for something they have to make happen. They want to be paid themselves, in the future, for the risk and effort they put into the business to turn potential into reality. This is important to understand as a seller. By doing a balanced valuation, you will arrive at a price that is close to what a buyer will be willing to pay.

Another frequent mistake, especially among startups, is to have a survivorship bias. They point at successful startups like Meta, Spotify, Alphabet or PayPal as proof of how potential can be realized in the future. But investors know the facts: Only 1 in 10 startups survive in the long run, and all seasoned investors will factor this risk into their bidding.

Need a Business Valuation in San Antonio?

Nielsen Valuation Texas can help you with an unbiased business valuation based on fair market value. Contact us today for a free consultation.